The strategy is designed to manage exposure across market regimes. Its objective is not constant outperformance, but reduced drawdowns and more stable long-term compounding. Periods of relative outperformance typically emerge during market stress and are preserved during subsequent expansions.

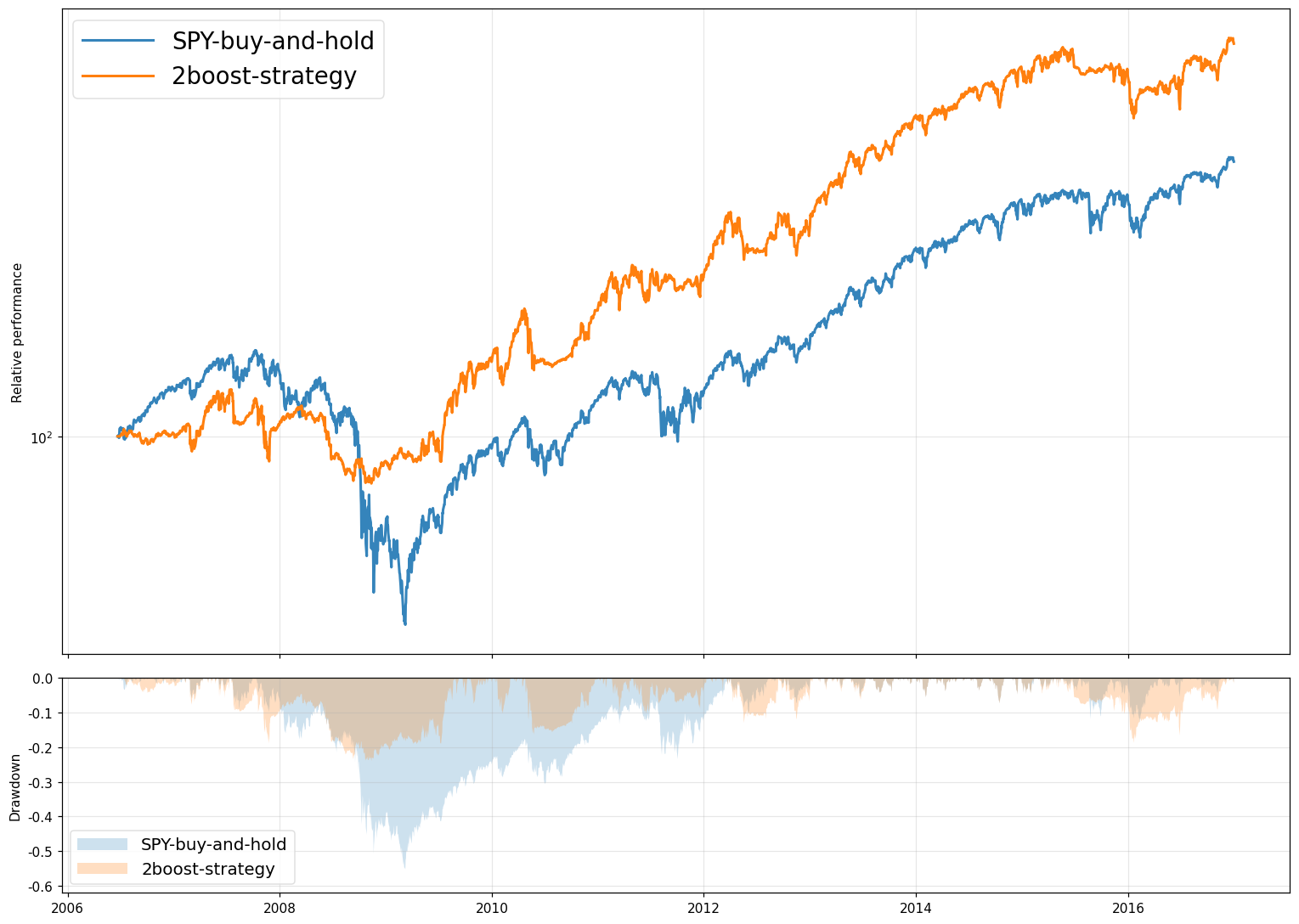

In-Sample Testing

Period: 22 Jun 2006 – 31 Dec 2016

This phase represents the model’s performance during the development and optimization window.

| Metric | Value |

|---|---|

| CAGR | 11.54% |

| Volatility | 15.79% |

| Sharpe Ratio | 0.77 |

| Maximum Drawdown | -24.04% |

| Final Multiple | 3.15× |

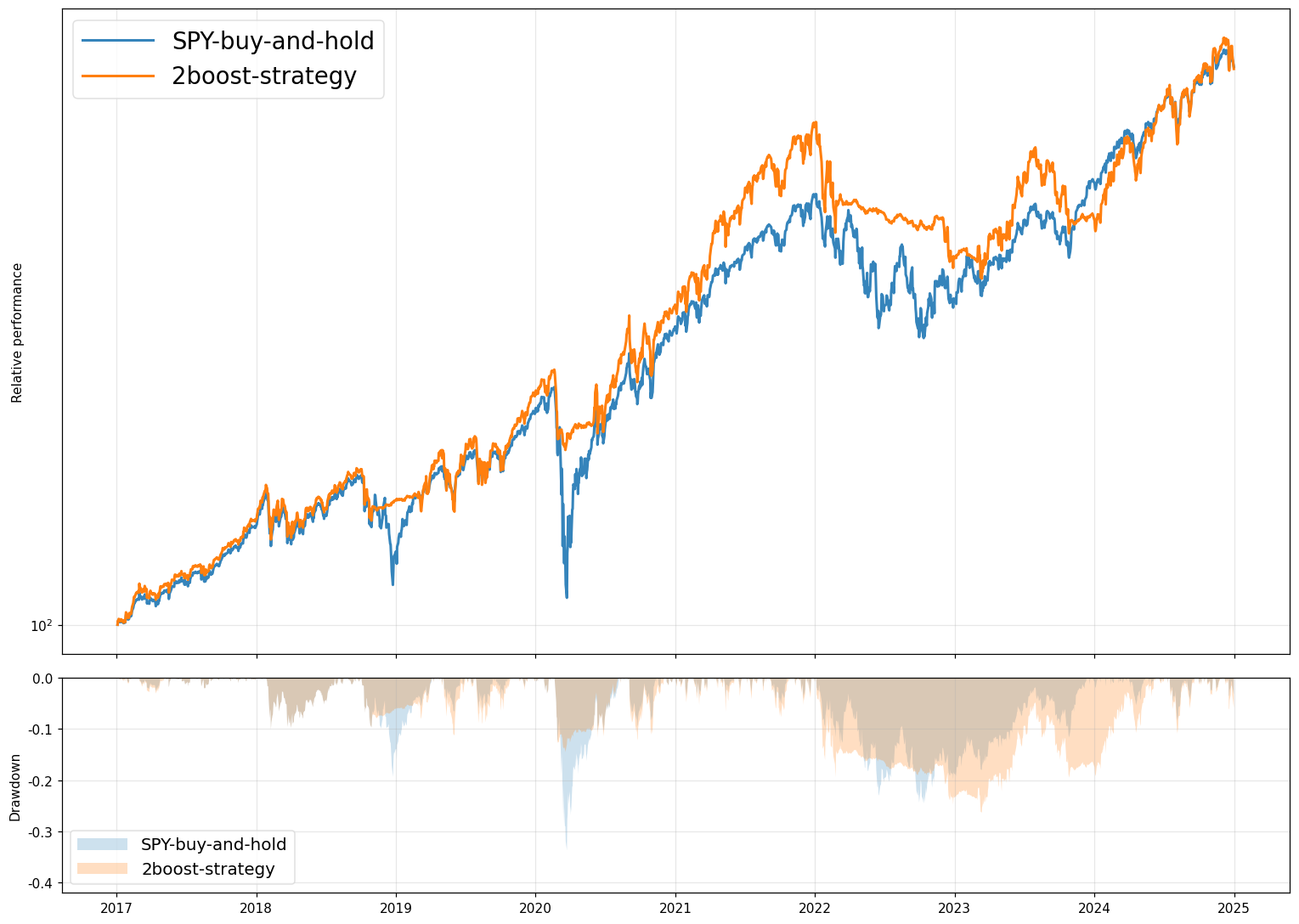

Out-of-Sample Testing

Period: 01 Jan 2017 – 31 Dec 2024

To prevent curve-fitting, we tested the model on unseen data from future cycles.

| Metric | Value |

|---|---|

| CAGR | 14.56% |

| Volatility | 16.22% |

| Sharpe Ratio | 0.92 |

| Maximum Drawdown | -26.33% |

| Final Multiple | 9.43× |

Disclaimer: Backtests are based on historical data and assume ideal execution conditions. Real-world results may differ due to market conditions, liquidity, and execution constraints.